Protect your financial future with proactive offshore trusts asset protection planning.

Protect your financial future with proactive offshore trusts asset protection planning.

Blog Article

Vital Insights on Offshore Count On Property Defense Solutions for Capitalists

When it comes to shielding your wide range, overseas counts on can be an important solution. They offer lawful frameworks that protect your assets from lenders and lawful insurance claims while improving your privacy. Maneuvering via the intricacies of these depends on calls for cautious consideration. Selecting the ideal jurisdiction and comprehending the benefits and threats involved is important. What details variables should you take into consideration to ensure your offshore count on offers your interests successfully?

Recognizing Offshore Trusts: A Detailed Review

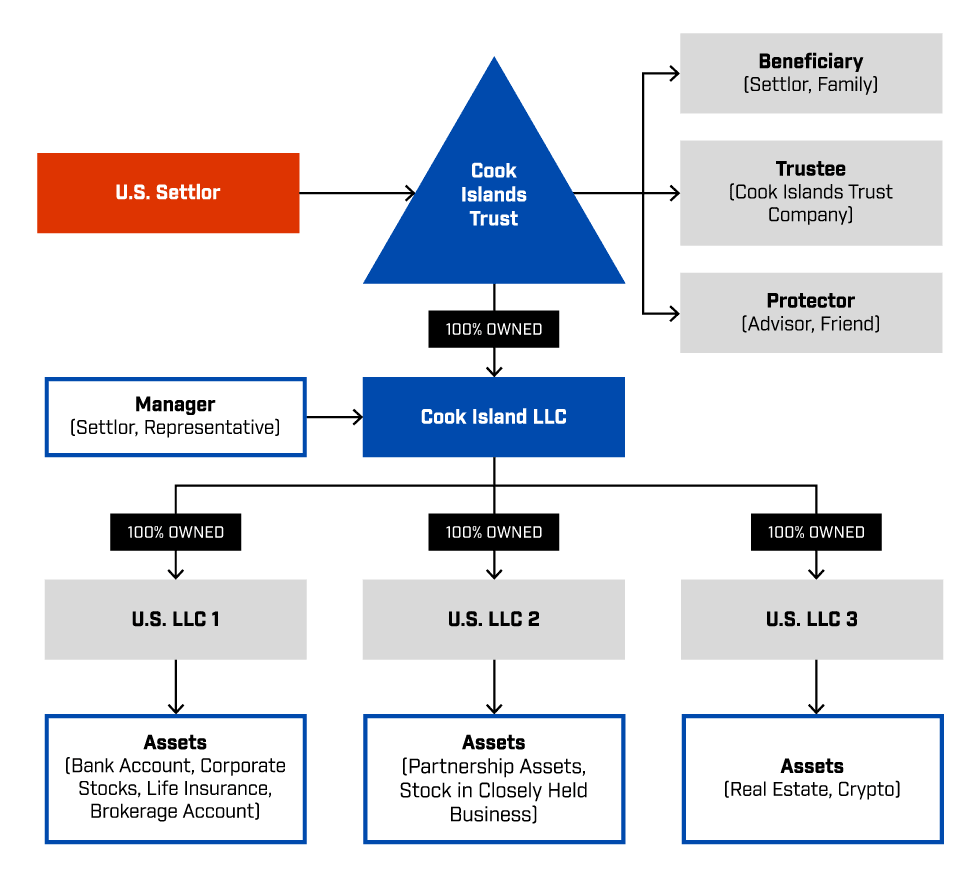

When taking into consideration asset defense, comprehending overseas counts on is essential. Offshore counts on are legal entities developed in territories outside your home country, designed to guard your assets from potential risks. You can produce these trusts for numerous reasons, such as privacy, riches monitoring, and, most importantly, defense versus financial institutions and legal insurance claims.

Generally, you assign a trustee to take care of the count on, ensuring that your possessions are managed according to your dreams. This separation between you and the possessions helps protect them from lawful susceptabilities and potential financial institutions.

While developing an overseas depend on might involve preliminary costs and complexity, it can offer tranquility of mind knowing your wide range is safe. You'll intend to extensively investigate different territories, as each has its own laws and tax obligation ramifications. Understanding these subtleties will certainly empower you to make informed choices about your possession protection approach.

Secret Benefits of Offshore Count On Property Security

When you think about offshore depend on property security, you expose substantial advantages like enhanced personal privacy steps and tax obligation optimization methods. These benefits not just safeguard your riches but also give you with greater control over your financial future. offshore trusts asset protection. Recognizing these crucial advantages can assist you make informed choices about your assets

Improved Privacy Measures

Although you might already recognize the financial benefits of offshore counts on, among their most engaging attributes is the boosted personal privacy they supply. By placing your assets in an overseas trust fund, you secure your riches from public scrutiny and possible lenders. This level of discretion is especially valuable in today's globe, where privacy is significantly in jeopardy.

You can select jurisdictions with rigorous personal privacy laws, ensuring your economic affairs stay discreet. Offshore trusts can also aid you different individual and service properties, additionally safeguarding your identity and interests. This privacy not only safeguards your properties but likewise gives comfort, allowing you to focus on your financial investments without the anxiousness of unwanted interest or disturbance.

Tax Optimization Techniques

Legal Frameworks Governing Offshore Trusts

Understanding the lawful structures governing overseas trusts is essential for anybody pondering this property defense strategy. offshore trusts asset protection. These frameworks vary considerably throughout jurisdictions, so it is necessary to familiarize on your own with the policies and needs in your selected location. A lot of offshore counts on run under the legislations of details countries, typically made to offer beneficial problems for property security, privacy, and tax obligation performance

You'll need to review variables such as count on registration, trustee responsibilities, and recipient rights. Conformity with global laws, such as anti-money laundering laws, is likewise essential to stay clear of lawful issues. In addition, some territories have specific rules pertaining to the legitimacy and enforceability of counts on, which can affect your total approach.

Choosing the Right Territory for Your Offshore Trust

How do you select the appropriate jurisdiction for your overseas trust? Look for countries with robust property security regulations that line up with your goals.

Following, evaluate tax obligation ramifications. Some territories use tax obligation benefits, while others may impose high tax obligations on depend on revenue. Select a place that maximizes your tax effectiveness.

A well-regarded place can enhance the trustworthiness of your trust fund and provide peace of mind. Having dependable lawful and monetary consultants can make a substantial difference in managing your trust fund properly.

Typical Types of Offshore Trusts and Their Uses

When taking into consideration overseas trust funds, you'll come across different kinds that serve various purposes. Revocable and irreversible counts on each offer unique advantages relating to versatility and property protection. Furthermore, asset protection click reference counts on and philanthropic remainder counts on can aid you safeguard your riches while supporting causes you appreciate.

Revocable vs. Unalterable Trusts

While both revocable and unalterable depends on offer necessary duties in offshore property defense, they operate quite in a different way based upon your objectives. A revocable trust fund permits you to maintain control over the properties during your lifetime, allowing you make adjustments or revoke it entirely. This versatility is wonderful if you desire accessibility to your possessions, yet it does not offer solid protection from creditors because you're still thought about the owner.

On the other hand, an unalterable trust transfers possession of the assets far from you, supplying a more powerful shield versus financial institutions and lawful insurance claims. Once established, you can't easily alter or withdraw it, however this durability can improve your asset security method. Picking the ideal type relies on your specific demands and long-term objectives.

Possession Protection Trusts

Possession defense trust funds are crucial tools for safeguarding your wide range from potential lenders and lawful insurance claims. One usual type is the Residential Asset Defense Count On (DAPT), which enables you to preserve some control while securing properties from lenders. An additional alternative is the Offshore Property Protection Depend on, commonly set up in jurisdictions with solid privacy regulations, offering better protection against lawsuits and creditors.

Charitable Rest Trusts

Charitable Rest Depends On (CRTs) offer an one-of-a-kind method to attain both philanthropic objectives and economic benefits. By developing a CRT, you can give away possessions to a charity while preserving earnings from those properties for a specific period. This technique not only supports a charitable cause yet additionally provides you with a possible income tax reduction and helps in reducing your taxable estate.

You can select to receive earnings for an established term or for your lifetime, after which the continuing to be properties go to the assigned charity. This twin advantage enables you to take pleasure in economic adaptability while leaving a long lasting effect. If you're looking to balance philanthropic purposes with personal monetary requirements, a CRT may be a perfect option for you.

Possible Risks and Risks of Offshore Depends On

Although offshore trusts can use significant benefits, they aren't without their prospective challenges and threats. You may encounter higher expenses related to developing and maintaining these trusts, which can consume into your returns. Furthermore, navigating through intricate legal structures and tax regulations in various jurisdictions can be frustrating. If you don't comply with neighborhood legislations, you could reveal yourself to lawful charges or possession seizure.

Ultimately, not all overseas territories are developed equivalent; some might do not have durable defenses, leaving your properties at risk to political or financial instability.

Actions to Establish Up and Handle Your Offshore Depend On

Next off, select a trusted trustee or depend on firm experienced in managing overseas counts on. It's critical to fund the depend on appropriately, moving assets while sticking to lawful requirements in both your home nation and the overseas jurisdiction.

When established, on a regular basis testimonial and upgrade visite site the trust fund to mirror any kind of adjustments in your economic scenario or family members characteristics. By complying with these steps, you can safeguard your possessions and accomplish your financial goals effectively.

Frequently Asked Inquiries

Just How Much Does Establishing an Offshore Depend On Normally Expense?

Setting up an offshore trust usually sets you back in between $3,000 and $10,000. Elements like complexity, jurisdiction, and the provider you pick can affect the overall expense, so it is crucial to investigate your choices thoroughly.

Can I Be the Trustee of My Very Own Offshore Trust Fund?

Yes, you can be the trustee of your own offshore trust fund, however it's typically not recommended. Having an independent trustee can provide added possession protection and reputation, which could be useful for your financial approach.

What Occurs to My Offshore Trust if I Relocate Countries?

If you relocate countries, your overseas depend on's legal condition might transform. You'll need to think about the new territory's legislations, which might impact tax obligation ramifications, reporting needs, and possession defense. Consulting a legal specialist is vital.

Are Offshore Trusts Based On United State Tax Obligations?

Yes, offshore trust funds can be subject to united state taxes. If you're a united state taxpayer or the trust has U.S. properties, you'll need to report and perhaps find more pay taxes on the earnings created.

How Can I Gain Access To Funds Kept In an Offshore Count On?

To accessibility funds in your overseas count on, you'll commonly need to comply with the trust fund's distribution guidelines. Consult your trustee for details procedures, and confirm you recognize any tax implications before making withdrawals.

Final thought

In verdict, overseas trust funds can be effective devices for securing your properties and safeguarding your riches. While there are dangers included, the peace of mind and safety and security that come with a well-structured offshore count on frequently outweigh the potential drawbacks.

Report this page